Rumored Buzz on Transaction Advisory Services

Transaction Advisory Services - An Overview

Table of ContentsTransaction Advisory Services - An OverviewThe 6-Second Trick For Transaction Advisory ServicesHow Transaction Advisory Services can Save You Time, Stress, and Money.Transaction Advisory Services Fundamentals ExplainedThe 45-Second Trick For Transaction Advisory Services

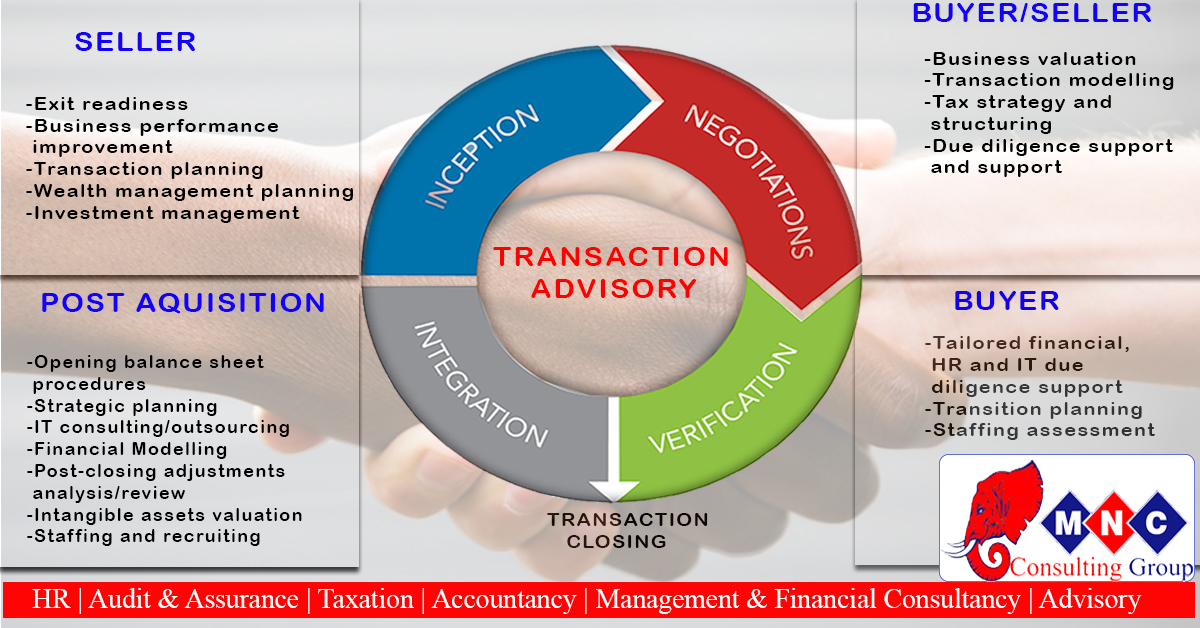

This step makes sure the service looks its finest to potential customers. Getting the organization's worth right is crucial for a successful sale.Deal consultants step in to aid by getting all the needed info arranged, responding to questions from customers, and setting up visits to the business's area. Deal consultants use their experience to assist business proprietors take care of hard settlements, fulfill buyer expectations, and structure deals that match the proprietor's goals.

Meeting legal regulations is critical in any organization sale. They assist service proprietors in intending for their next actions, whether it's retired life, beginning a new venture, or managing their newfound riches.

Purchase experts bring a wide range of experience and knowledge, making sure that every facet of the sale is handled skillfully. Via tactical preparation, assessment, and settlement, TAS helps entrepreneur accomplish the greatest possible list price. By guaranteeing lawful and regulative compliance and handling due persistance together with other deal staff member, transaction consultants reduce potential dangers and responsibilities.

Little Known Facts About Transaction Advisory Services.

By contrast, Big 4 TS teams: Deal with (e.g., when a possible buyer is performing due diligence, or when an offer is closing and the purchaser requires to integrate the firm and re-value the vendor's Annual report). Are with costs that are not connected to the offer shutting efficiently. Gain costs per interaction somewhere in the, which is less than what investment banks gain even on "little deals" (however the collection possibility is also a lot greater).

, however they'll concentrate much more on accounting and assessment and less on topics like LBO modeling., and "accounting professional just" topics like test balances and just how to walk via occasions utilizing debits and debts rather than monetary declaration adjustments.

The Ultimate Guide To Transaction Advisory Services

that demonstrate how both metrics have altered based upon items, channels, and customers. to judge the accuracy of administration's previous forecasts., consisting of aging, supply by item, average levels, and arrangements. to establish whether they're completely imaginary or rather credible. Professionals in the TS/ FDD groups might likewise speak with monitoring concerning every little thing over, and they'll create a detailed report with their findings at the end of the process.

The pecking order in Deal Providers varies a little bit from the ones in see this here financial investment banking and private equity careers, and the basic form appears like this: The entry-level function, where you do a great deal of information and monetary analysis (2 years for a promo from below). The next level up; comparable work, however you obtain the more intriguing little bits (3 years for a promo).

Specifically, it's hard to obtain advertised past the Manager level because couple of people leave the task at that stage, and you require to start showing evidence of your capacity to create income to development. Allow's start with the hours and way of living because those are much easier to define:. There are occasional late nights and weekend work, however nothing like the frantic nature of investment banking.

There are cost-of-living modifications, so expect reduced compensation if you're in a cheaper place outside significant economic (Transaction Advisory Services). For all placements other than Companion, the base pay comprises the mass of the complete settlement; the year-end reward could be a max of 30% of your base income. Usually, the very best way to boost your profits is to change to a various company and negotiate for a greater wage and bonus

Transaction Advisory Services Can Be Fun For Anyone

You might get involved in company growth, yet financial investment financial obtains much more tough at this phase due to the fact that you'll be over-qualified for Analyst duties. Company finance is still a choice. At this stage, you need to just remain and make a run for a Partner-level function. If you desire to leave, perhaps relocate to a client and do their evaluations and due diligence in-house.

The primary problem is that since: You normally need to sign up with another Large 4 group, such as audit, and work there for a couple of years and afterwards relocate into TS, job there for a few years and after that relocate right into IB. And there's more helpful hints still no assurance of winning this IB duty since it depends on your area, customers, and the employing market at the time.

Longer-term, there is likewise some risk of and due to the fact that examining a company's historic monetary info is not exactly rocket science. Yes, human beings will always need to be entailed, yet with advanced innovation, reduced head counts might possibly support customer interactions. That stated, Website the Transaction Providers group defeats audit in terms of pay, job, and leave opportunities.

If you liked this post, you may be curious about reading.

The Of Transaction Advisory Services

Establish advanced financial frameworks that help in identifying the real market worth of a firm. Supply advisory job in connection to company valuation to aid in bargaining and pricing frameworks. Describe the most ideal type of the deal and the sort of consideration to utilize (cash money, supply, make out, and others).

Develop activity prepare for risk and direct exposure that have been recognized. Carry out assimilation preparation to identify the procedure, system, and organizational adjustments that may be needed after the deal. Make mathematical price quotes of combination prices and benefits to analyze the financial rationale of integration. Establish standards for incorporating departments, technologies, and service processes.

Identify prospective decreases by lowering DPO, DIO, and DSO. Analyze the potential client base, sector verticals, and sales cycle. Think about the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The functional due persistance supplies essential insights into the performance of the firm to be obtained concerning risk evaluation and value development. Determine temporary alterations to finances, banks, and systems.